The data centre business is moving to relative newcomers among vendors, says researcher Dell'Oro Group.

The data centre business is moving to relative newcomers among vendors, says researcher Dell'Oro Group.

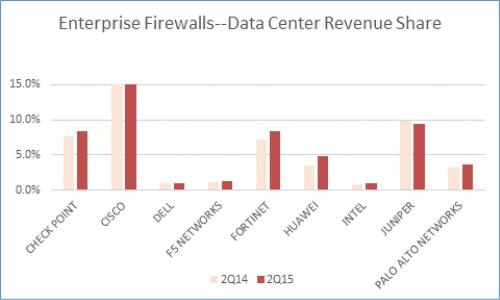

Digging deeper into the Enterprise Firewall market (now at about $1bn quarterly-run rate and growing a little over 10% per year), it has separated those products optimised for data centre deployment versus those optimised at the edge of the campus as the dynamics of these two locations require very different features.

It says it noticed 'quite a bit of change in the data centre firewall market as the up-start vendors (Fortinet, Palo Alto) grab some of the business in the data centre'. \

Cisco dominates the market and represents about 40% of market sales. Fortinet was aggressive in 2Q15 and Huawei is also showing traction, it says.

Security analyst Casey Quillin said that Fortinet's strength came from a broad base of large Enterprise customers, not just one or two.

The quarterly strength was characterised by the number of customers issuing contracts greater than $1.0m more than doubling compared to the year ago period, although most customers are based in the USA.

Distributor ScanSource has enhanced its management structure for its Communications and POS and Barcode business units in Europe.

Distributor ScanSource has enhanced its management structure for its Communications and POS and Barcode business units in Europe.