Distributors' expansion seems to have been built on expanding portfolios and ranges of products sold, as well as selling more to partners, according to the latest database report by IT Europa, 'Distributors in Europe - the top 500'.

The report found that Europe's channels have grown again after a period of decline following the recent financial crisis, but that consolidation has changed the top players' list.

The report profiles 500 companies, including: 14 parent companies, 135 subsidiaries, 335 independents, and 16 public companies (traded on stock exchanges).

The combined revenues for all companies in 2015 was $153.75 billion (€141.3 billion) with a combined staff employed figure of 100,007. Overall, total revenues of all companies increased 7.25% in 2015 (based on 2014 revenues) compared to 2013 (when the report was last published). However, between the financial years of 2012 and 2014 that market decreased by 14.67%.

In the last year, the European market has seen many new products coming across the Atlantic as US companies look for growth opportunities, helped by the US dollar/Euro rate of exchange. Some distributors have signed up several new vendors each month, particularly in the security area. This has enabled portfolio expansion, often with centralisation of costs leading to economies, but in the challenging new technology areas, distributors have also had to invest in staff and support, with some larger firms setting up specialist units.

The distributor market is growing steadily across Europe despite quite a few of the smaller distributors going out of business, quite often, due to being acquired by larger parent companies. In general, Eastern European Distributors are doing well, with the exception of those in Slovakia. Conversely, a few of the Southern European countries such as Portugal and Cyprus are finding things harder, based on their recent revenues.

The top ten companies by revenue are listed below. New entries in 2015 were Exertis Group, Westcoast Ltd and ASBIS Group. Distributors no longer in the Top 10 (but were in 2013 when the last report was published) were MERLION ZAO and Specialist Distribution Group (SDG) Ltd.

Rank by Revenue Company

1 Tech Data Europe

2 Ingram Micro Europe

3 ALSO Holding AG

4 Exertis Group

5 DCC Technology

6 Avnet Technology Solutions EMEA

7 Arrow Enterprise Computing Solutions (ECS) EMEA

8 Esprinet S.p.A.

9 Westcoast Ltd

10 ASBIS Group

In terms of distributors' software offering, the most common type of software distributed was Network / Security / VPN Software (65.6%); followed by office software (52.4%); and storage software (26.8%).

The most common type of hardware distributed was Networking Hardware (72.2%); followed by PC Accessories & Consumables (68.8%); Printers & Scanners (62.4%); Enterprise Storage & Other Data Storage (62.2%); and PCs/Notebooks/Laptops/ Non-Windows PCs (58%).

In terms of the geographical markets, the top three countries in 2015 that were most widely covered were Germany (56 company profiles), United Kingdom (56) and France (50). The geographical markets which experienced the most revenue growth from 2013 to 2014 were: Ukraine (21.29%), Turkey (20.92%), Hungary (19.92%), Ireland (17.5%), and Czech Republic (14.56%). Markets which experienced revenue decline were: Portugal (-5.27%), Cyprus (-8.98%), and Slovakia (-9.47%).

The volume of products across all software categories increased between 2013 and 2015. The top 5 category volume increases were in: Linux Software increased by 77.48%, followed by Console & PC Games/Education Software (64.22% increase), Internet/Server Software (54.26%), and Network / Security / VPN Software (50.61%).

Volume of products also increased in most hardware categories except Digital Cameras (-1.59%) and Motherboards (-6.45%). The top 5 hardware types which had increase in volume between 2013 and 2015 were: CPU (52.24%), Telecom/IT Cabling (27.69%), Printers & Scanners (26.6%), PCs, Notebooks, Laptops & Non-Windows PCs (25.17%) and Servers (24.72%).

A large proportion of distributors are selling third party products indirectly but those distributors who are selling their own branded products are equally distributing their products both directly and indirectly across the channel. Distributors who are selling through the channel indirectly are primarily doing it through resellers, retailers and systems integrators.

The Distributors in Europe - the top 500 database report spans 38 countries and represents the most detailed view available of this key market sector. It has been compiled from detailed interviews by IT Europa's own research team.

The report is available from IT Europa (www.iteuropa.com) costing from £2,350.

Data can also be extracted and supplied by country, region or on a bespoke basis.

For the third consecutive year Yorkshire-based Lily Comms picked up Ericsson-LG's Best Partner of the Year Award at the vendor's Global Partner Conference in Shanghai, China.

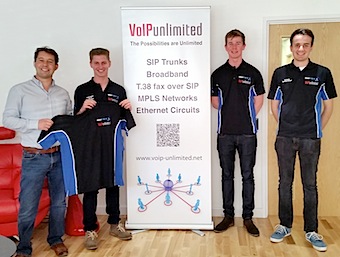

For the third consecutive year Yorkshire-based Lily Comms picked up Ericsson-LG's Best Partner of the Year Award at the vendor's Global Partner Conference in Shanghai, China. VoIP Unlimited is to sponsor Southampton University's 2016 Formula Student team (SUFST) for the second year running.

VoIP Unlimited is to sponsor Southampton University's 2016 Formula Student team (SUFST) for the second year running.