Purple WiFi, the cloud-based Social WiFi software company, has added Location Based Services to its WiFi solution.

Location Based Services offer the host venue insights into consumer information and behaviour. It also provides opportunities to market to and engage customers directly via features such as Facebook demographic reporting, zoning reporting and vouchering.

Nisa Cardiff and Camden Market are already utilising the geo-fencing feature, drawing invisible lines around particular sales areas or locations.

This allows the business to gauge what purchases the customer might be considering and send information or offers in real-time to their mobile device.

Purple WiFi also allows the business to understand who is visiting and using the free WiFi, how long they are online, as well as their age, gender and any other relevant information that's included in their social networking profile.

Nisa in Cardiff have found that providing free Purple WiFi has brought more customers into the shop and increased their dwell time. As a result, sales of coffee, snacks and other products have increased.

Using Location Based Services allows Nisa to track the customer's journey around the store and adjust product displays accordingly.

The team has already identified corners of the shop where nobody goes, which had not been recognised previously. They have also been able to increase their social media engagement, gaining 'Likes' and 'Follows' which provide an opportunity for regular dialogue with their customers.

At Camden Market, the team has taken advantage of Purple WiFi's Facebook demographic and zoning reporting capabilities. This has enabled the identification of visitor's interest preferences from Facebook, which can be compared with national averages in order to show distinctive characteristics and better target marketing campaigns for specific traders.

Camden Market has found the vouchering tool to be particularly useful for photography competitions and promoting live events.

In addition, Camden Market has also looked at footfall in detail across the estate, identifying choke points and pinpointing common entrance and exit points, as well as how men move through the space versus women.

The customer has the right to opt-in or opt-out of tracking. If a customer is not opted in, Purple WiFi's software can still detect an anonymous MAC address, confirm whether that MAC address is a new or repeat visitor, and see how long that device stays.

If a customer is opted in, the device MAC address can be linked to personal data, such as their age, gender, name, email address, location, language, Likes, etc. meaning relevant vouchers can be pushed to the visitor.

David Morris, Head of IT at Nisa Retail, said: "The system is providing us with essential demographic information about consumers visiting these sites. The intention is to use this data to gain competitive advantage, drive consumer promotional activity and record the impact against sales."

Jac Timms, IT Manager, Camden Market, added: "Providing a large outdoor and indoor public hotspot over Camden Market had its challenges, but thanks to Purple WiFi's cloud based solution we were able to get up and running very rapidly. The set up was fast and Purple WiFi helped us to fine tune the system and increase location accuracy, it was smooth from start to finish.

"Being able to market to visitors when they arrive at specific venues combined with rich analytics has been a real bonus for us."

Gavin Wheeldon, CEO, Purple WiFi, stated: "From the retailer's point of view, useful customer information and footfall data can be collected and used to better target offers and in-store signage.

"From the customer's point of view, offers can be delivered direct to their device when they are in the location looking at a product area, meaning the offer is relevant there and then.

"But this is only the beginning. The next stage of development might include functionality such as requesting help from retail assistants, and skipping queues to pay all via the customer's mobile device."

Hosted comms provider MyPhones.com has fuelled its accelerating drive into the UK channel following a distribution agreement with SOS Communications. The move is a key component of MyPhones.com's strategy to gain significantly more market share and comes as the number of subscribers to its Altos hosted telephony platform reaches an all time high.

Hosted comms provider MyPhones.com has fuelled its accelerating drive into the UK channel following a distribution agreement with SOS Communications. The move is a key component of MyPhones.com's strategy to gain significantly more market share and comes as the number of subscribers to its Altos hosted telephony platform reaches an all time high. Work is also under way to establish SOS Communications as a direct provisioning point for Altos hardware; and dealer launch events are being planned to support these developments.

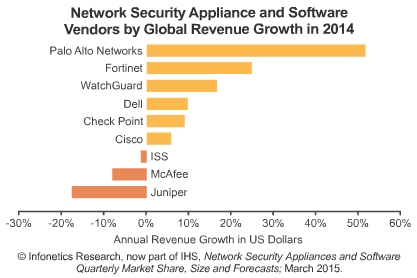

Work is also under way to establish SOS Communications as a direct provisioning point for Altos hardware; and dealer launch events are being planned to support these developments.  "Closing out 2014 on a positive note with strong performances by most of the top vendors, and especially Palo Alto Networks and Fortinet, the network security space has been on a roll as a result of some very large data centre and cloud projects," said Jeff Wilson, principal analyst for security at Infonetics Research.

"Closing out 2014 on a positive note with strong performances by most of the top vendors, and especially Palo Alto Networks and Fortinet, the network security space has been on a roll as a result of some very large data centre and cloud projects," said Jeff Wilson, principal analyst for security at Infonetics Research.